Was Tesla expected to build a plant in Malaysia, or did our propositioning fall to the wayside? – Auto News

On August 6th, Thai newspaper The Nation had published a report stating Tesla had dropped plans to invest in manufacturing facilities across Southeast Asia, including in Thailand, Indonesia, and Malaysia, stirring considerable debate online.

Many in the local sphere were quick to point out that Tesla had never explicitly announced any intention to establish manufacturing operations in the country. In an effort to clarify the situation, our Minister of International Trade and Industry (MITI), Tengku Zafrul took to his official Facebook page, stating, “MITI has never announced that Tesla would develop a factory in Malaysia. While we have had discussions with Elon Musk to attract investment, Tesla has never committed to opening a factory here.”

That said, Tesla’s apparent suspension of their Southeast Asian plans does also come at a time of a global slowdown in demand for EVs and increased competition from rival brands, particularly ones from China.

Prime Minister Datuk Seri Anwar Ibrahim’s comments today seem to underscore this sentiment, citing information directly received by Zafrul, saying “Tesla is facing losses and cannot compete with EVs from China.”

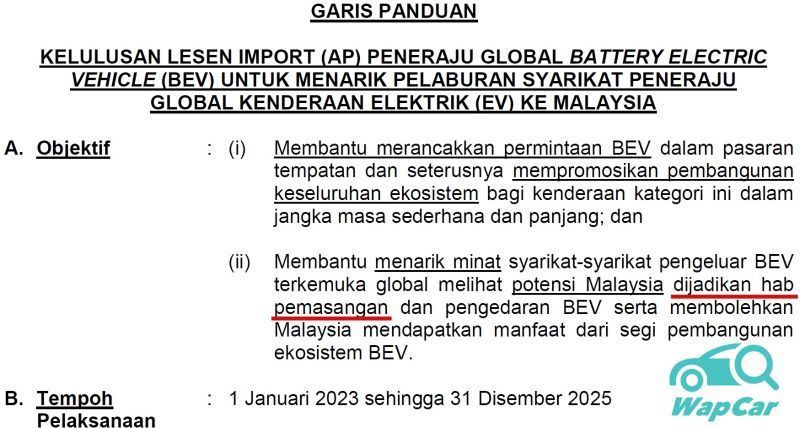

Sure, Tesla may not have previously committed to establishing a factory in Malaysia, but setting up local manufacturing was always Malaysia’s long-term goal, which were tied to the incentives offered to Tesla under Malaysia’s Global Electric Vehicle (EV) Battery Leader Initiative. It still is.

This initiative was designed to extend various benefits to companies in the EV space like Tesla, with the eventual hope being to nudge them into investing in local manufacturing capabilities. As astutely pointed out by our friends at WapCar, MITI’s document does outlines these objectives, revealing that the goal of offering Tesla these privileges was to pave the way for deeper, more significant investments in the country.

Zafrul noted the unverified nature of the statements made in the Thai report, suggesting that the media should seek further confirmation rather than relying on an anonymous insider. The most direct path to this, obviously, is to ask Musk directly over a tweet to his X account – merely sliding into his DMs might be a tad improper.

This calls back to a larger narrative and broader timeline in which (and when which) the governments of Thailand, Indonesia, and Malaysia seemingly all vying for Tesla’s attention in unison, each hoping to secure to favour with the American EV maker and its CEO, one of the world’s richest individuals.

In Indonesia, President Joko Widodo, was keen to woo Tesla, especially as his party, PDI-P, were preparing for elections. In February 2023, Jokowi announced that Tesla was close to finalising a deal to establish a manufacturing facility in Indonesia, a move that would have been a significant political win. Tesla, for its part, was more interested in tapping into the country’s rich lithium reserves.

Meanwhile in Thailand, Prime Minister Srettha Thavisin, who came to power later in August 2023 following a three-month legal battle, was another one of the leaders in the region eager to engage with the Tesla CEO. In September, just a month following his rise to office, he announced that he was in talks with Musk, posting about it on X (formerly Twitter).

Closer to home, Malaysia’s Prime Minister Anwar Ibrahim also entered the fray, announcing in July 2023 that Tesla was going to ‘invest’ in Malaysia. Again, here’s where the vagueness of what can be implied strikes again as those familiar with the situation understood that Tesla’s ‘investment’ in Malaysia would most likely be relatively modest.

Essentially, it involved renting property in Cyberjaya as their new country HQ, the setting up of showrooms (Tesla Experience Centres) in high profile shopping complexes, and the investment necessary to establish a network of Tesla Supercharger stations, of which 30{aa25fa8b82bb550df44f4514fef8e475020994699e2c082d49d75b275e3029cc} must be opened to other brands of Battery Electric Vehicles (BEVs). All this isn’t exactly tantamount to a ‘significant’ investment.

At this juncture, it’s also worth noting that Malaysia had also granted Tesla further special privileges by waiving Franchise AP (Approved Permit) requirements, and it remains the only brand to receive such a concession.

However, this decision alienated long-standing automotive partners who had invested heavily in Malaysia’s automotive manufacturing sector such as Mercedes-Benz, Volvo, and BMW, brands that have been operating in Malaysia for decades and had continued to invest despite these taxation hurdles and other requirements.

The narrative that the Malaysia Global Electric Vehicle (EV) Battery Leader Initiative was tailored specifically for Tesla is hard to turn away from, as evidenced by the strict criteria that narrows the eligibility to the exclusion other manufacturers.

In order to qualify, companies must be BEV manufacturers with (1) significant sales growth in the past five years, (2) possess a minimum 1GWh battery plant, and (3) have its own ultra-fast charging technology with a capacity above 180 kWh.

This effectively rules out the majority of automotive brands competing in the space either due to their relative youth, outsourcing of battery manufacturing, and not operating an own-brand charging network – all of which are characteristic of most, if not all, of Tesla’s competitors.

Leading BEV manufacturers like BYD and Hyundai, who are themselves setting up manufacturing plants in Thailand and Indonesia, seemingly do not meet the grade.